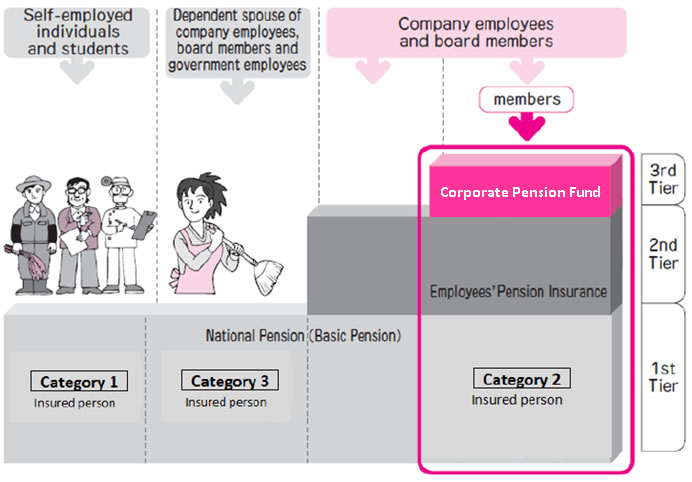

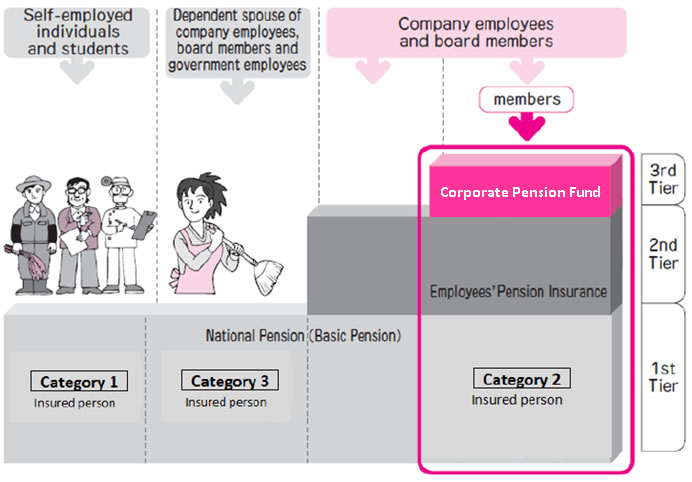

Employees’ Pension Insurance and Science and Technology Corporate Pension Fund

Note: 1st, 2nd and 3rd Insured Persons refer to the three categories of the National Pension program.

When you join RIKEN you will be automatically enrolled in two pension programs: Employees’ Pension Insurance, which is based on the National Pension program, and the Science Technology Corporate Pension Fund. Each program has its own rules for retirement payments or partial refunds that you may apply for if you leave Japan before the age of retirement. See below for details.

|

Employees’ Pension Insurance |

Science and Technology Corporate Pension Fund |

| Pension plan |

This is the main government-run pension insurance program for salaried workers in companies, providing the “earning-related pension” in addition to the Basic Pension provided by the National Pension program. |

This is a corporate pension program that will provide you with an additional pension on top of that provided by the National Pension program. |

| Premium |

The Employees’ Pension Insurance premium is co-paid. Part of the premium is paid by the employer. The premium amount is based on employee earnings, and the employee share is automatically deducted from the monthly salary. |

The Science and Technology Corporate Pension Fund premium is an optional co-pay system. Part of the premium is paid by the employer. The premium amount is based on employee earnings. The employee contribution to the fund is optional. If the employee decides to contribute to the fund, it will be automatically deducted from the monthly salary. |

Pension

benefits |

- Old-age Pension*

(Old-age Employees’ Pension + Old-age Basic Pension)

- Disability Pension

(Disability Employees’ Pension + Disability Basic Pension)

- Survivors’ Pension

(Survivors’ Employees’ Pension + Survivors’ Basic Pension)

* To be qualified to receive the Old-age Pension, the total enrollment period needs to be 10 years or more. |

- Corporate Pension*

- Lump-sum Payment for Survivors

* To be qualified to receive the Corporate Pension, the enrollment period needs to be one month or more with conditions.

<Conditions>

- If you are enrolled in the system for 15 years or more, only one option is available.

Corporate pension (from the age of 60)

- If you are enrolled in the system for less than 15 years, two options are available.

① Lump-sum withdrawal payment

② Corporate pension (from the age of 65)

|

Information for non-Japanese |

<Lump-sum Withdrawal Payment for non-Japanese>

For short coverage periods, of at least 6 months, under the Employees’ Pension Insurance system, you can apply for a Lump-sum Withdrawal Payment after leaving Japan.

There is a maximum limit for the total Lump-sum withdrawal Payment. 20.42% income tax is deducted from the payment. It is possible to get a tax refund; the refund can be claimed at a later date through a personal representative (acting Tax Agent).

For more information, click here

(In 9 languages: Chinese, English, Indonesia, Korean, Pilipino, Portuguese, Spanish, Thai and Vietnamese)

< International Social Security Agreements with Japan>

Japan has bilateral social security agreements with a number of countries. The agreements allow you to combine the period(s) of social security coverage in Japan and the other agreement country to meet the minimum requirement for the Japanese old-age pension. Please confirm the agreement status with other countries of employment.

Note: If you receive the Lump-sum Withdrawal Payment of your Japanese pension contributions, participation in a social security agreement is not possible.

A request for the estimate of the Lump-sum Withdrawal Payment and the Old-age Pension can be made at any Japan Pension Service Branch Office.

For more information, click here |

<Same as above> |

| Link for complete details |

Japan Pension Service |

Pension Fund Association |

August 1, 2017